Life is a long and winding journey with plenty of challenges and obstacles to overcome along the way.

You may find yourself suddenly having to deal with a variety of issues that might put a strain on your emotional and financial wellbeing.

So, taking steps to ensure you have safety nets in place to protect you and your family from worst-case scenarios could give you added peace of mind.

Here’s how financial protection might help give you a boost, as well as a few types of cover you may want to consider.

An increasing number of Brits are cancelling their protection to save in the short term – this could be a mistake

According to FTAdviser, amid the ongoing cost of living crisis and with interest rates continuing to soar, an increasing number of Brits are opting to cancel their protection to make short-term savings.

While it is important to ensure you have enough funds in place to cover essential outgoings, such as rent or mortgage payments, or utility bills, cancelling your cover could leave you exposed.

According to the Actuarial Post, 31% of Brits admit to prioritising non-essential expenses, such as a Netflix account or gym membership, over life insurance. Protection is often mistakenly viewed as a non-essential outgoing, but if the worst occurs, you’ll likely wish you had some in place.

Advised individuals with protection in place report the best outcomes for their financial and emotional wellbeing

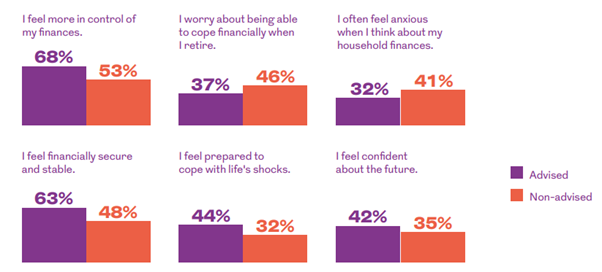

Royal London undertook a study into the emotional and financial wellbeing benefits derived from receiving financial advice. They found that individuals who received financial advice reported better outcomes for their emotional wellbeing, as shown by the graphic below:

Source: Royal London

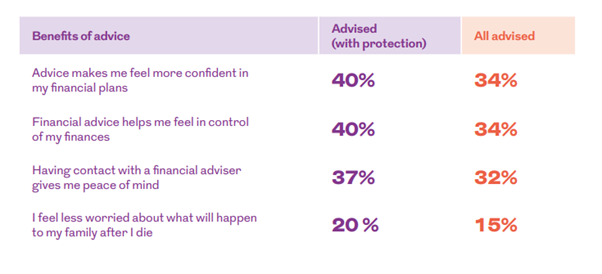

Crucially, though, the boost to emotional and financial wellbeing was even greater for those who both received advice and had protection in place, as shown by the graphic below:

Source: Royal London

The study also found that of advised individuals with protection:

- 73% reported feeling in control of their finances, compared to the UK national average of 57%

- 46% reported feeling prepared for life’s shocks and unexpected challenges, compared to the UK national average of 35%.

Ensuring you have the right protection in place to provide you with a safety net should certain scenarios occur could provide you with a sizeable boost to your peace of mind.

3 common types of protection you may want to consider taking out

- Income protection

Income protection pays you a regular income in the event you are unable to work due to accident, illness, or injury. You’ll typically receive this money until you either return to paid work or you retire.

Having income protection in place could ensure that if the worst occurs and your income is disrupted, you have a safety net in place to continue to cover your essential outgoings.

It means you don’t have to dip into your savings to pay bills, and insurers often provide complementary services you can take advantage of to help you get back to work sooner.

- Critical illness cover

Critical illness cover specifically provides a tax-free lump sum if you’re diagnosed with a life-changing illness that could have a long-term effect on your wellbeing.

This might involve:

- A heart attack or stroke

- An accident resulting in an amputation

- Degenerative diseases such as Parkinson’s or multiple sclerosis

Critical illness cover could provide you with a lump sum to help you cope with any additional health-related expenses or loss of income relating to your illness.

- Life insurance

If you were to die unexpectedly, you are likely to want funds in place to provide for your family’s financial needs.

Life insurance could provide them with a significant payout, helping them resolve any short-term financial issues and also paying for costs arising from your death, such as funeral costs and solicitor fees.

This could provide a much-needed boost to your loved ones’ emotional and financial wellbeing during an incredibly stressful time.

It is important to find a balance between maintaining cover and providing for your essential outgoings – we can help

It is all well and good suggesting you continue to pay for multiple forms of protection when you’re facing mounting bills and increased outgoings.

It is important that whatever you decide, you strike up a balance between your short-term needs and ensuring you have safety nets in place should the worst occur.

To discuss how to find a balance and where protection factors into your long-term financial plans, please email us at beyourself@murphywealth.co.uk or give us a call on 0141 221 5353.

Please note

Note that financial protection plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production