Back in May, FTAdviser reported that HMRC had collected £700 million in Inheritance Tax (IHT) in April alone. This figure marked an £85 million increase compared to April 2023.

With IHT allowances currently frozen, and likely to remain so until at least 2028, an increasing number of estates are likely to become liable to a tax charge. One way to combat this is through robust estate planning.

You might think that this is something to think about only in later life, but estate planning should form part of your financial plan from the outset.

It’s also vital that you have a will in place. A will is the simplest way to make your wishes known, so be sure it remains up to date and reflects your wishes, whatever life throws at you.

Births, deaths, and marriages can mean you need to revisit your will, so ensure it remains up to date

A will is the simplest way to make your wishes on death known. And yet, recent research from Canada Life has found that more than half (51%) of UK adults have not written a will. Even more worryingly, this figure includes 13% who intend to never make one.

The report also looked at the main reasons why Brits choose not to make a will. It found that:

- 26% believe that they don’t have sufficient assets to warrant putting a will in place

- 23% believe they have plenty of time to make a will so there’s no rush

- 14% simply don’t want to pay for a will, despite the fees starting from around £30 (and rising to £500 or more).

The consequences of not having an up-to-date will in place are huge, causing stress and worry for those you leave behind. But talking about death isn’t always easy.

MoneyAge recently confirmed that 57% of Brits haven’t spoken to their adult children about their will. Meanwhile, a 2021 report (also from MoneyAge) found that 45% of parents plan to split their wealth unevenly between children on top.

Clearly, communication is key to avoiding will disputes and ensuring that your wishes are understood and adhered to. And remember, even once your will is in place, life events like the birth of a child, a divorce, or a death could mean you need to revisit it. So, be sure your will is always up to date.

Estate planning and IHT mitigation should be a key part of your long-term financial plan from the outset

The current freeze to the nil-rate and residence nil-rate bands means that the Treasury’s IHT take is on the rise.

Careful estate planning can help mitigate frozen allowances and lower the potential tax bill faced by those you leave behind.

Rather than being something to think about only in later life, you’ll want to think about a potential liability early and begin to take steps to mitigate it. One of the key ways you might do this is via gifting.

Gifting can be a tax-efficient way to lower the value of your estate for IHT purposes

Gifting will likely form a key part of your estate planning strategy. It’s a great way to lower the value of your estate for IHT purposes and it has some other financial and non-financial advantages too.

You can give as many gifts as you like during your lifetime, and they will usually be tax-free as long as you live for a further seven years after making the gift. This is known as a “potentially exempt transfer (PET)”.

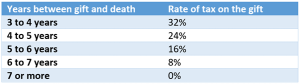

IHT is usually charged at 40%, but gifts are subject to “taper relief”. This means the rate of IHT you pay reduces depending on how long you live after making a PET.

The taper applies as follows:

Source: HMRC

While you might be planning to pass on your wealth in your will, giving during your lifetime can lower the value of your estate and mean that you’ll be around to see the difference your money makes.

You might even use HMRC exemptions to give gifts that are IHT-free from the moment you make them. These include:

Your annual exemption

This allows you to gift up to £3,000 IHT-free for the 2023/24 tax year. The £3,000 limit is individual to you and can be carried forward for up to 12 months.

You and your partner could gift £12,000 this year if neither of you used your allowance last year.

Normal expenditure out of income exemption

You can make regular IHT-free gifts – into a child’s savings or investments, for example – as long as the gift is made from your normal income, forms part of your usual outgoings, and doesn’t affect your standard of living.

Small gifts exemption

You make as many gifts of up to £250 as you like, IHT-free. This exemption is great for Christmas and birthday presents, say.

Get in touch

If you’d like to discuss any aspect of your estate or your long-term financial plans, please get in touch. Please email us at beyourself@murphywealth.co.uk or give us a call on 0141 221 5353.

Please note

The information contained in this blog was correct at the time of writing and may be outdated at the time of reading.

The Financial Conduct Authority does not regulate estate planning or will writing.

Production

Production