One of the key parts of any financial plan involves preparing for your eventual retirement. If you are likely to retire in the next few years, or have recently retired, you might have spent a considerable amount of time carefully planning for your post-work life.

So, it might be worrying if you find yourself looking at the lives of your adult children and grandchildren and see them financially lagging behind where you found yourself at their age.

Millennials and Generation Z have faced a wide range of difficulties arising from global events and changes in society. They have had to deal with rapidly rising costs, greater career obstacles, and the consequences of events, such as the:

- 2008 global financial crisis

- Covid-19 pandemic

- Current cost of living crisis.

The additional strains on their ability to earn money and save efficiently are likely to have consequences for their long-term plans.

So, taking the time to review ways you might be able to help them in the present and prepare for their futures could be useful. Here are some of the challenges they face and how you might be able to help.

Wage stagnation and inflation have made pension contributions an afterthought

Generation Z is the first generation to have benefited from the rules of pension auto-enrolment across their working lives. Many millennials will likely have benefited from the changes introduced in 2008 too.

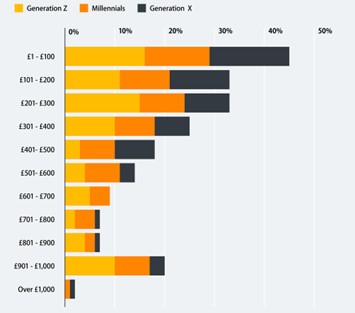

Despite this, PensionBee reports that the majority of millennial and Generation Z workers are saving less than £100 each month into their workplace pension, as shown by the graph below:

Source: Pension Bee

The graph doesn’t include those who are saving nothing at all, with 27% of millennials and 17% of Generation Z reporting they’ve been unable to save throughout the pandemic.

Saving has become increasingly difficult, especially in light of long-term wage stagnation. The BBC reports that British workers are £11,000 worse off each year due to 15 years of wage stagnation.

Meanwhile, according to LinkedIn News UK, 54% of millennials say they live month-to-month, which effectively stops them pursuing any kind of meaningful savings.

These factors are likely to have contributed to Pension Bee’s findings that 67% of Generation Z and 52% of millennials plan to delay their eventual retirement.

Getting onto the property ladder has become challenging due to rising costs and difficulty saving

Data from the Resolution Foundation’s intergenerational audit uncovered that the number of millennials living in rental property at age 30 is more than three times the rate of their parents or grandparents from the “baby boomer” generation.

Beyond that, millennials are also paying more in rent each month, even when figures are adjusted for inflation.

According to This is Money, life-long renters will face significant challenges in retirement. They could require at least £617,000 in savings, as well as a State Pension to afford a decent place to live and maintain a moderate lifestyle.

However, avoiding this issue by getting onto the property ladder in the first place will likely require a significant deposit – which might not be doable if your loved one is living payday to payday.

3 useful ways you can help your children or grandchildren prepare for their eventual retirement

- Consider helping your loved ones get onto the property ladder

As mentioned, the difference between owning their home and renting it could be significant for your child or grandchild’s eventual retirement outgoings.

So, considering steps to help your family onto the property ladder as first-time buyers, such as helping them with their deposit, could provide them with a useful boost.

Additionally, you could opt to leave your own home to your children or grandchildren in your will.

This could help you reduce any potential Inheritance Tax (IHT) on the estate you leave behind, as it’ll fall under what is known as the “residence nil-rate band”. This allows you to pass on up to £175,000 from the value of your main residence to your children or grandchildren free of IHT.

- Look at gifting your wealth while you’re still alive to help them overcome major challenges

Gifting, such as providing money for a house deposit, can be an incredibly tax-efficient way to help your loved ones overcome financial obstacles.

It can allow you to take proactive steps to help them prepare for their own futures while you’re still alive, rather than waiting for any eventual inheritance once you’re gone. It might also help you reduce a future IHT liability.

Read more: Why discussing your estate plans with loved ones might give them peace of mind

You can gift in a variety of ways, including:

- Gifts using your annual gifting exemption, standing at £3,000 in the 2023/24 tax year, or £6,000 if you combine your allowance with a spouse or civil partner

- Gifts at a wedding, with the tax-free amount depending on how you know the couple

- Small gifts of up to £250, given to as many recipients as you choose (provided they have not received a gift from you under another exemption)

- Regular gifts taken directly from your income, assuming you meet certain criteria

- Gifts of any amount made at least seven years before you die.

It is important to follow the rules and regulations surrounding gifting to the letter of the law to avoid falling foul of IHT and leaving your loved ones facing a hefty bill.

To learn more about the different kinds of gifts you can make, how they work, and any rules you need to be aware of, you should get in touch with us to discuss the matter further.

- Review ways you might be able to help them save

If your children or grandchildren are young enough, you might be able to save on their behalf into a Junior ISA (JISA). You can save up to the JISA allowance each tax year (£9,000 in 2023/24) into a tax-efficient account, provided your loved one is under the age of 18.

You can also encourage extended family members or close friends to contribute directly to the JISA as well.

If your children or grandchildren are already adults, one of the simplest ways you might be able to help them get on top of their finances and start to save efficiently is to help them get financial advice.

Setting them up with a financial planner could help get them on the right path towards major life milestones and preparing for their long-term futures.

Read more: 5 useful ways financial planning can help boost your emotional and financial wellbeing

Get in touch

If you are worried about your children or grandchildren and the financial obstacles they’re facing in life, it might be worth taking professional advice.

A good first step could be to reach out to us by email at beyourself@murphywealth.co.uk or give us a call at 0141 221 5353.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production