Lives are meant to be lived. They’re full of experiences and people. They’re journeys spanning years or decades taking in major milestones along the way.

Financial plans are designed to guide you along that journey — down the path of least resistance — allowing you to enjoy individual moments, as we work with you towards reaching your long-term goals.

Take a moment and close your eyes. Try to visualise the life you would like in 10 years. Now think about 20, 30, or 40 years. Your financial plan is going to help get you to a place where that vision is a reality.

Read on to discover five ways financial planning can help boost your financial and emotional wellbeing, as it helps you stay on track towards unlocking your dream lifestyle.

- A financial plan is tailored to you personally, so you can feel safe in the knowledge that your needs are being met

The core of any successful financial plan is one thing — you. Your plan should suit your needs, your circumstances, and your individual goals and dreams. It should be ready to adapt, evolve, and grow with you.

This is a key part of our ethos at Murphy Wealth. A notion we like to refer to as “Human First”, or simply put, understanding an individual before money becomes involved.

Before we get started, we’ll want to understand:

- Your background, interests, family, and previous experiences

- Your tolerance to financial risk

- The major milestones you are working towards

- How much you’ll need to feel secure in life

- Your ultimate goals and dreams.

If you’ve worked with us, you’ll likely have had meetings with us to help us get to know you better before your plans were put in place.

This tailored approach — of advising you, not just your money — can help you feel content, as you are reassured that the person you’ve trusted with your finances is constantly working in your best interests.

- A financial plan accounts for short-term obstacles giving you a sense of added security and protection

Short-term issues such as rising interest rates, market instability, or high inflation might make you feel naturally nervous about the state of your plans.

However, while a financial plan is typically built around long-term objectives — such as major milestones or lifelong goals — they are also often designed to account for short-term obstacles along the way.

At Murphy Wealth our mantra is “Plan. Protect. Grow. Repeat”. It is expected that things will change over time. So, we work with you through regular meetings and communication to ensure your plans are constantly relevant and up to date.

Knowing that your plans will be ready to deal with any obstacles that come your way can give you a useful boost to your sense of security and stability.

- Working on your plans over the long term — alongside an adviser — can boost your emotional wellbeing

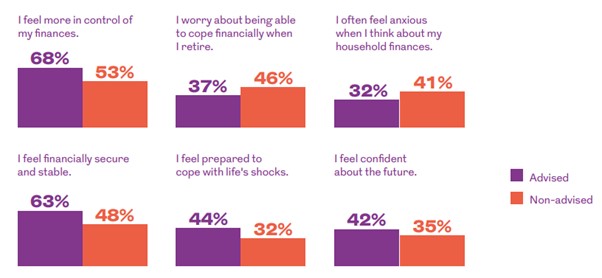

Research from Royal London discovered that individuals routinely reported better financial and emotional outcomes when working alongside a financial planner compared to those who went without advice, as shown by the graphic below:

Source: Royal London

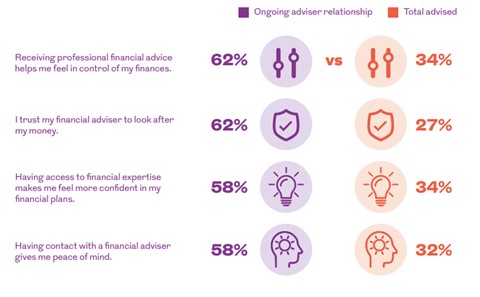

Clients who developed strong, long-lasting relationships with their advisers also reported better outcomes across a range of areas.

Source: Royal London

The emotional benefits of having a financial plan in place and working with an adviser over a long-term period shouldn’t be underestimated.

Working with a financial planner to develop and maintain a long-term financial plan can help improve your financial confidence and peace of mind, while reducing anxiety and related stress.

- Working on your plans over the long term — alongside an adviser — can boost your financial outcomes

One of the key components of a successful financial plan is generating enough growth on your wealth to unlock your desired lifestyle and provide for your long-term goals.

Working alongside a financial planner to develop a carefully tailored plan supported by data and cashflow forecasting can produce significant gains over time.

According to research produced by the International Longevity Centre (ILC), advised individuals who had fostered ongoing relationships with their advisers had up to 50% more pension wealth than those who had only received advice once.

The ILC data also shows that high net worth or “affluent” individuals who received advice were 11% better off with their pension plans than their unadvised counterparts and had a 24% uplift in their non-pension financial wealth, such as investments and savings.

A strong financial plan is designed to grow your wealth over time, so that when the time comes, you’ll have enough to unlock your dream lifestyle and feel safe and secure throughout retirement.

- A financial plan accounts for your major milestones in life and can leave you feeling better prepared to face life’s challenges

Your life is likely to encompass many major milestones. You will probably have things you expect or want to achieve, and potentially loved ones you’d like to help support with their own goals as well.

A financial plan can prepare you for life’s big events and ensure you’re financially ready to tackle them. This might include:

- Buying a home or helping a loved one purchase their own

- Supporting your children or grandchildren with private education or university costs

- Paying for your wedding or helping a loved one with their expenses

- Setting up or exiting a business

- Coping with unexpected health problems or assisting a loved one with their care needs

- Preparing yourself for retirement and ensuring your estate is sorted for once you’re gone.

Working alongside a financial planner, you can cultivate a plan that prepares you to face these challenges and ensures protections are in place to support you. So, even if the worst occurs, you can feel confident that you have the necessary safety nets in place to help keep you on track.

Wherever you happen to be, we’re here for you.

Our doors are always open to clients, new and old, and if you have any worries or concerns, or want to understand how a financial plan can help make your life easier — you should get in touch.

It doesn’t matter where you are in life because we’re always here for you. To start a conversation email us at beyourself@murphywealth.co.uk or give us a call at 0141 221 5353.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production