The UK economy has faced enormous challenges over the last few years.

Covid created historic swings in Gross Domestic Product (GDP), with a 19% fall followed by a 17% rebound, all within three months – a level of change not seen since the Office for National Statistics (ONS) first began measuring GDP change back in 1955.

Despite this bounce-back, and later data revisions, the UK’s economic recovery remained slower than the US. The cost of living crisis, too, has meant that the recovery wasn’t felt by UK workers and consumers.

But the tide is turning.

From falling inflation to rising GDP and increased market resilience, there are many reasons to be optimistic about the economy for the rest of 2024 and beyond. Here are just five of them.

- Inflation has been falling steadily since the end of 2022

Inflation hit a 41-year high back in October 2022, when it peaked at 11.1%. Since then it has been falling steadily. The latest ONS figures confirm a Consumer Prices Index (CPI) of 3.2% for the 12 months to March 2024, down from 3.4% in February.

Source: ONS

This is good news for consumers struggling with the high food and energy prices that have characterised the cost of living crisis. The CPI does, though, remain higher than the Bank of England’s (BoE) own target of 2%.

The BoE uses base rate changes as a tool to help regulate inflation, through regular meetings of its Monetary Policy Committee (MPC).

At its most recent meeting, the MPC confirmed that it expected inflation to be near the BoE’s 2% target in the near term before rising again to around 2.5% in the second half of 2024.

The MPC minutes went on to confirm that CPI inflation is projected to be 1.9% by 2026 and 1.6% by May 2027.

- The base rate is set to drop… soon

When the MPC last met, they opted to keep the base rate at 5.25% for the sixth meeting in a row. But MoneySavingExpert confirms there are now strong signs that a rate cut is imminent. As mentioned above, the BoE use the base rate to help control inflation.

When inflation spiked after Covid, the base rate rose. A base rate increases the cost of borrowing (bad news if you have a mortgage) while encouraging saving, leading to consumers spending less. As overall spending drops, prices stop rising so quickly and inflation is expected to slow.

MoneySavingExpert quotes BoE governor Andrew Bailey as “optimistic that things are moving in the right direction”. Analysts, meanwhile, expect a base rate drop in August.

This is good news for borrowers and, although a drop might not be immediately reflected in your mortgage, it is a sign of the economy heading the right way.

- Stock markets rallied in 2023 and have started 2024 strongly

After a couple of tough post-pandemic years, global stock markets rallied in 2023.

JP Morgan reported that the highest-performing index (Japan’s TOPIX) had delivered year-to-date returns of 28.6% by December 2023. Even the lowest-performing index in 2023, the MSCI Asia ex-Japan, returned more than the top performer in 2022.

The signs for 2024 are similarly encouraging. Experts predict a gradual recovery during the rest of the year, helped by base rate cuts, and increased investor confidence.

- GDP is expected to grow this year

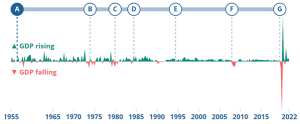

The coronavirus pandemic prompted a historic shock to the UK economy.

The chart below shows the 2022 GDP drop alongside historic falls coinciding with, among other events, the late-50s Suez Crisis, the 1979-1981 “Winter of Discontent”, and the 2008 global financial crisis.

Source: ONS

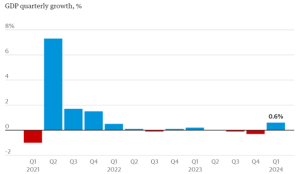

Since the 2022 drop, the economy has been showing signs of recovery, despite a mild recession at the end of 2023. The Guardian reports that the recession is now officially over after the ONS confirmed 0.6% growth for January to March 2024. This marks the strongest quarterly growth since 2021.

Source: The Guardian

Growth is clearly good news but it is expected to be slow going, in the short term at least. The BoE predicts growth of 0.5% for 2024.

- News reports focus on the negatives so things are rarely as bad as they seem

If you find yourself worrying about market movements or doomscrolling through social media news feeds, remember that bad news sells. It can be all too easy to concentrate on negative stories while failing to step back and look at the bigger picture.

The general outlook for the next few years is optimistic, with inflation and base rates falling, and a return to economic growth.

Remember that your investments are long-term. They are designed to ride out periods of volatility so, as best you can, try to ignore the noise of global and domestic market shifts and focus only on your goals. And if you need reassurance, remember we’re always on hand to help.

Get in touch

To discuss your long-term investments or any concerns you have about the effect of global market performance on your money, get in touch. Please email us at beyourself@murphywealth.co.uk or give us a call on 0141 221 5353.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production